COMMENTARY

From polls to ports: How México’s election could transform trade

As México prepares for its presidential election in June of this year, one crucial aspect that demands attention from candidates and voters alike is the country’s logistics infrastructure, which is critical for sustaining and enhancing cross-border trade.

Amid the global shift towards nearshoring, logistics in México has surged in strategic importance, positioning it as a pivotal element in North America’s supply chain resilience. México finds itself uniquely positioned to capitalize on the shifting global supply chain dynamics. However, to fully embrace the benefits of this opportunity, it is necessary for México to prioritize developing and modernizing its logistics network.

Logistics encompasses the planning, execution, and control of the movement and storage of goods, services, and related information from the point of origin to the point of consumption. It involves a complex public and private infrastructure network, including roads, railways, ports, airports, warehouses, and distribution centers. Logistics efficiency relies heavily on a skilled workforce, advanced technology, and well-defined trade corridors.

Each logistics element is interconnected to ensure the smooth flow of goods and services across borders, connecting manufacturers, suppliers, and consumers. As such, a robust and well-coordinated logistics system is fundamental for México to enhance its competitiveness, attract foreign investment, and foster economic growth in the face of the nearshoring trend.

According to the Asociación Mexicana de Logistica (AML), México ’s public infrastructure to support its logistics network consists of 117 seaports, over 370,000 kilometers of roads, close to 27,000 kilometers of railway lines, and 76 airports, of which 64 are international, and 66 rail and intermodal terminals that help connect the different modes of transport.

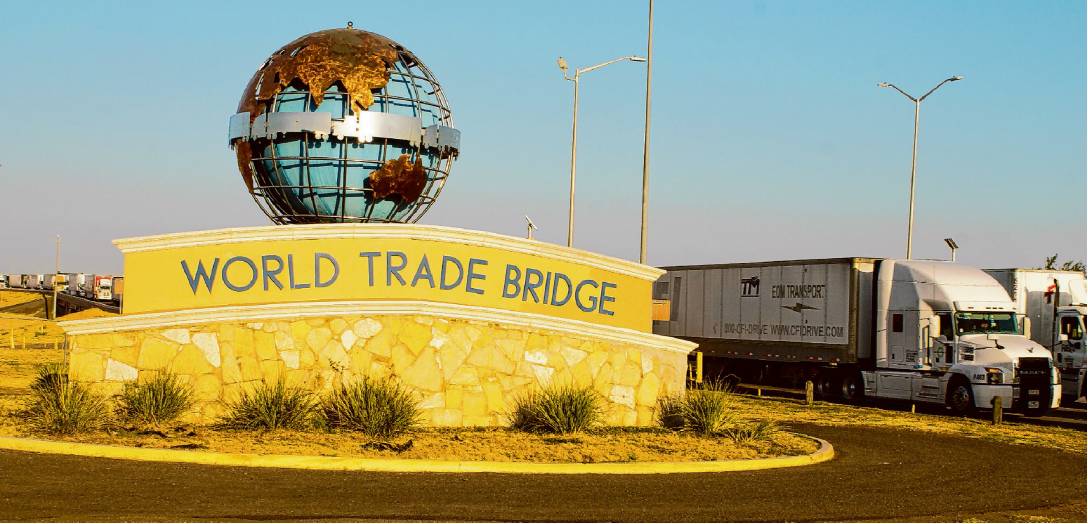

Additionally, México has 63 border crossings, supporting trade with neighboring nations, and 49 Customs offices strategically placed across the country. Among these Customs offices, 19 are located along the northern border, two on the southern border, 11 inland, and 17 at maritime ports.

The impact of nearshoring on México’s economy is evident in last year’s foreign direct investment (FDI) announcements. According to the Secretaría de Economía, in 2023, there were 378 FDI announcements totaling over 110 billion pesos, equivalent to 6.7% of México ‘s 2022 GDP.

These investments are expected to create 234,725 new jobs, with 47% of the announcements related to the automotive industry. The primary manufacturing sectors benefiting from nearshoring include automotive assembly (41%), auto parts manufacturing (16%), steel and iron manufacturing (8%), electronic components (7%), and the beverage industry (6%).

The top 10 countries contributing to these investments account for 91% of the announcements, with the United States leading at 38%, followed by China (12%), Denmark (9%), Australia (7%), South Korea (6%), Argentina (5%), Germany (5%), France (4%), Taiwan (3%), and the Netherlands (2%), emphasizing international confidence in México ‘s growing role as a critical hub in North American logistics and manufacturing.

As companies aim to locate closer to their main end markets to improve supply chain resilience in the face of an increasing number of disruptive events and to enhance reliability in terms of time and costs, which reduces inventory levels and increases customer service quality, México must provide logistics certainty to businesses looking to establish operations within the country.

This requires improving the governance of the freight and logistics transport system to optimize the flow of goods between production zones in México and final market consumption centers. Structured governance necessitates the participation of leaders from government agencies that impact the country’s logistics performance and representatives from industry and academia. Together, they should aim to design and monitor actions that promote intermodality and reduce environmental impact, congestion, and insecurity in transportation and logistics infrastructure while increasing industrial competitiveness, resilience, and security of supply chains operating within the country.

By addressing these critical aspects, México can strengthen its position as a logistics hub and attract companies seeking to nearshore their operations, ultimately benefiting from increased investment, job creation, and economic growth.

For México to enhance the value of its transportation infrastructure and prepare for the adoption of new technologies such as hydrogen-fueled and electric engines and innovative transport modes like cargo airships, it is essential that the country’s logistical framework evolves. However, the lack of a “logistics culture” in the country leads to little value or importance being attributed to the coordination of actions among the different actors in the logistics system, including companies, government, and academia.

To address this issue and achieve the desired technological advancements, it is highly recommended that México fosters a culture of logistics excellence through increased awareness, education, and training. This will address the shortage of skilled logistics professionals and improve decision-makers capacity in the sector, ultimately reducing costs and improving efficiency.

México can create a more cohesive and effective logistics ecosystem by promoting collaboration and shared responsibility among stakeholders. As other economic and social sectors benefit from this enhanced logistics culture, México will be better positioned to adopt and integrate cutting-edge technologies (Logistechs) into its transportation infrastructure, ultimately leading to increased competitiveness and sustainable growth.

The growing trend of companies shifting their operations to México has led to a rising demand for the transportation of domestic goods, imports, and exports. To effectively manage this increased traffic and minimize congestion on multiple segments of the federal highway network, which leads to pollution, cost overruns, accidents, and delays, it is necessary for México to prioritize monitoring and streamlining cargo flows.

This can be achieved by implementing a digital platform that enables real-time management and data-driven decision-making. Such a platform would allow for the dynamic allocation of resources and route optimization, reducing bottlenecks and improving overall efficiency in the transportation network. By leveraging technology to streamline traffic management, México can enhance the sustainability and safety of its transport infrastructure, ultimately supporting the growing logistical demands.

Texas A&M International University’s A.R. Sanchez, Jr. School of Business Texas Center for Border Economic and Enterprise Development will host the 12th International Congress on Logistics and Supply Chain (CiLOG) in September. This year’s CiLOG will provide a timely platform to address these critical issues.

The Conference brings together experts, industry leaders, and policymakers to discuss the future of logistics in the region. With the theme “Harnessing the Future of Logistics: Exploring the Role of Logistechs,” CiLOG 2024 will explore the challenges and opportunities presented by nearshoring and the role of technology in shaping the logistics landscape. Through keynote lectures, panel discussions, and workshops, participants will gain valuable insights and collaborate on strategies to enhance México ‘s logistics competitiveness.

By prioritizing the development and modernization of its logistics network, México can boost its competitive edge, draw in more international investment, and foster significant economic benefits. Enhancing logistics infrastructure will not only boost México ‘s competitiveness but also attract more foreign investment, create jobs, and drive sustainable economic growth.

This election year offers a crucial opportunity for all stakeholders – government, industry, and academia – to come together and commit to transforming México ‘s logistical capabilities, ensuring the nation can meet the demands of global trade today and set standards for logistical excellence in the future.

For the next administration, it will be necessary to demonstrate a strong commitment to investing in transportation networks, embracing digital transformation, and fostering a skilled workforce capable of driving the logistics sector forward. The country’s economic success will largely depend on its ability to adapt to global supply chain shifts and provide support to companies seeking to establish or expand their operations within México.

Dr. Daniel Covarrubias is the Director of Texas A&M International University’s A.R. Sanchez, Jr. School of Business’ Texas Center for Economic and Enterprise Development. Reach him at dcova@tamiu.edu.