2021 saw fewest oil discoveries in 75 years

Companies around the globe are investing less in exploration, new projects after recent busts

By Paul Takahashi STAFF WRITER

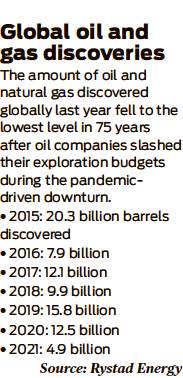

The amount of oil and natural gas discovered globally last year fell to the lowest level in 75 years after oil companies slashed exploration budgets during the pandemic-driven downturn.

Oil companies discovered 4.9 billion barrels of oil and natural gas in 2021, the lowest level since 1946, according to a report from Rystad. The Norwegian energy research firm called it a “considerable drop” from the 12.5 billion barrels discovered in 2020.

“A reduction in cumulative volume highlights the absence of large individual finds,” Rystad said in its report.

The lack of new oil discoveries is a concern for the oil industry, which must constantly replace depleting oil and gas reserves to maintain production levels and revenues. Industry analysts closely follow companies’ capital budgets to determine the direction of future oil production — and jobs for future projects.

Oil companies are making smaller discoveries, but not necessarily because the world is running out of fossil fuels. Rather, companies are investing less in exploratory drilling and new projects after recent oil busts.

The long-term implications of this underinvestment and decline in discoveries will depend on how the so-called energy transition plays out. If predictions of waning oil demand prove true, the reductions in supply will have little impact on prices. But if demand for petroleum remains strong, it could usher in a period of high energy costs, energy executives warned at the World Petroleum Congress last month.

After crude demand and prices plunged at the start of the pandemic, oil companies slashed spending on new projects by more than 27 percent to $334.7 billion in 2020, down from $461.7 billion in 2019. Although capital spending rose slightly in 2021, they remained about 25 percent lower than pre-pandemic levels, according to an analysis by Canadian bank RBC Capital Markets.

Oil companies discovered an average of 408 million barrels of crude and natural gas per month in 2021, down from an average of 1.7 billion barrels per month in 2015, according to Rystad. Some major discoveries last year included Exxon Mobil’s discoveries in offshore Guyana and Russian Lukoil’s discovery in November off the coast of Mexico.

Enverus, an Austin-based energy research firm, expects that drillers will raise capital spending by about 20 percent in 2022, which could lead to more oil and gas discoveries this year.

Exxon Mobil, the nation’s largest oil company, last month said it plans to spend between $20 billion and $25 billion on new oil projects next year, up from around $16 billion this year but still less than pre-pandemic level of $33 billion. Rival Chevron said it plans to spend $15 billion on new projects next year, an increase of more than 20 percent from 2021 levels but still lower than pre-pandemic levels of $19 billion to $22 billion.

The lower capital spending and lack of major oil discoveries, however, might not matter as the world shifts away from fossil fuels. The International Energy Agency warned last year that the world will need to stop drilling new oil and gas wells immediately to meet its net-zero target by 2050.

Some analysts predict global oil demand could peak this decade with the rise of electric vehicles and renewable energy such as wind and solar.

European oil majors, in particular, are aggressively shifting investment away from oil and gas projects toward solar, wind and electric vehicle charging stations. BP has pledged to no longer explore new basins or enter a new country to find the next giant oil field, and Royal Dutch Shell last year said its crude production peaked in 2019. paul.takahashi@chron.com