Conn. credit unions seek merger

Sikorsky Financial Credit Union looks to acquire Bridgeport City Employees Federal Credit Union

By Luther Turmelle

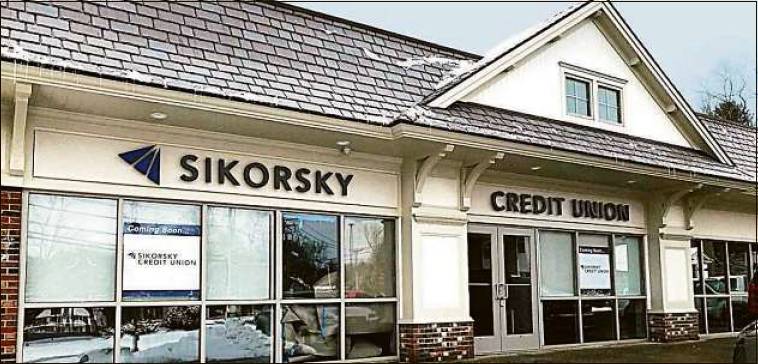

One of Connecticut’s largest credit unions, Sikorsky Financial, is looking to acquire a smaller rival that serves Bridgeport city employees, according to the state’s Banking Department.

Sikorsky Financial and Bridgeport City Employees Federal Credit Union filed a request to merge with state banking officials on Nov.

14. Terms of the deal were not immediately available this week.

The proposed acquisition would close on March 31, 2023, if approved. Officials with both credit unions were not immediately available for comment.

The Stratford-based Sikorsky Financial Credit Union has more than 55,000 members while the Bridgeport City Employees Federal Credit Union has 3,853 members. Sikorsky Financial has nine branches in Fairfield and New Haven counties, including three locations in Stratford, while the Bridgeport City Employees Federal Credit Union has just one branch.

The Bridgeport City Employees Federal Credit Union has 3,853 members and assets of $29.44 million. The credit union has been in existence since 1959.

Sikorsky Financial was founded in 1948 and has $1.1 billion in assets.

The deal, if approved, would be the sixth merger of state-chartered credit unions since 2020. There have been 19 mergers of state-chartered credit unions in the past decade

Bruce Adams, president and chief executive officer of the Meriden-based Credit Union League of Connecticut, said the deal is indicative of a reality many financial institutions are facing.

“It’s getting harder for the smaller institutions to compete,” Adams said. “The larger institutions have the level of scale to drive down the costs of operating.”

He said larger credit unions are well positioned to compete with banks for millennial and Gen Z customers.

“People in these age groups businesses that align with their own values,” Adams said. “And credit unions are very values focused.” luther.turmelle@hearstmediact.com