CT housing market could soften with rise in foreclosures

By Alexander Soule

As home buyers pick through Connecticut’s limited selection of properties heading into the spring market of 2021, the ugly underbelly of supply could come to bear on the market this year and next — lenders seizing properties from borrowers who, due to evaporating income, health bills or other reasons, cannot keep up with payments on their mortgages.

With little interest in carrying real estate that can be a headache to maintain, banks usually will take what they can get at auction, absorb any loss looming on a mortgage contact and move on. That creates a bargain-bin effect for the larger market, as buyers mull “as-is” properties under foreclosure versus those that have been spruced up in advance of sales.

As of Friday, the State of Connecticut Judicial Branch listed less than 200 homes and commercial properties statewide with pending foreclosure auctions. Bridgeport had the most with 16, with Norwalk and Stratford next with seven apiece and no other city having more than a half dozen.

“There is a federal foreclosure moratorium in place, currently through June 30 ... that impacts foreclosures involving federally-backed mortgages, so those cases are not being filed or proceeding at this time,” stated Rhonda Hebert, a spokesperson for the Connecticut Judicial Branch, in an email response to a query. “Foreclosures are being filed and are proceeding in cases where the mortgage is not federally backed.”

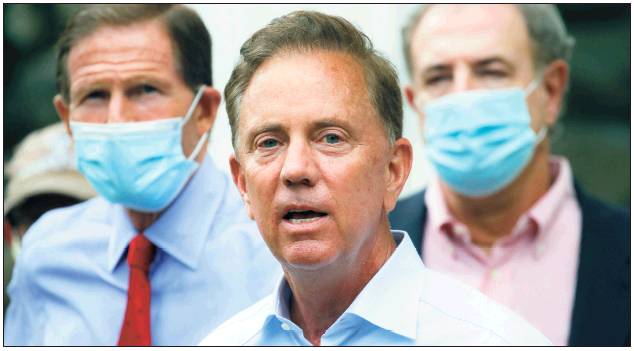

Asked this week about any federal measures he foresees to forestall foreclosures further, U.S. Sen. Richard Blumenthal cited as immediate priorities rent assistance and general relief payments that people can use to pay down amounts due on mortgages. Connecticut banks and credit unions have offered forbearance on payments, but they can only kick the can down the road for so long.

“All of these different pieces are linked together — if you put more money in people’s pockets, they can pay their rent or their mortgages,” Blumenthal said. “It addresses the eviction and the foreclosure crises we are facing in our economy.”

A booming market for now

Connecticut home sales continued to boom last month, with transactions up 15 percent statewide from February 2020 to nearly 2,900 properties sold, according to Berkshire Hathaway HomeServices New England Properties. Prices are rocketing even higher, with the median home sold for 24 percent more than its equivalent a year ago. Average prices are up 44 percent as many owners of upscale properties take advantage of the hot market to cash out.

Fairfield and Middlesex counties were particularly heated, with sales up roughly 35 percent in each.

The question becomes whether prices will drop in any rise in foreclosures, denting the seller’s market that mushroomed last year as New York City residents scour Connecticut towns for new homes outside the city. At the outset of the pandemic, Connecticut banks agreed to hold off any foreclosure actions to forestall any additional shock on families and the economy, but the clock is ticking on the problem loans they are carrying on the books.

Connecticut foreclosures peaked in 2009 with more than 27,000 actions that year, three times as many as in 2019 prior to pandemic moratoriums taking effect on foreclosures. The 2009 total equates to more than half of all homes sold in Connecticut last year.

In a 2010 study published in American Economic Review of the impact of Massachusetts foreclosures, researchers pegged at 27 percent the average discount on foreclosure properties compared to normal listings in their neighborhoods.

While more than enough new listings came on the market in February to replace the sold homes, Connecticut is not seeing nearly as many hit the market as in early 2020. But at some point, a fresh source of listings will emerge as lenders resume auctions, with the possibility of the state shunting some struggling borrowers into what is known today as the Ezequiel Santiago Foreclosure Mediation Program, set up during the Great Recession in an effort to keep people in their homes.

Auctions swept the state after 2008, including in Connecticut’s most affluent towns like Greenwich, Madison, Avon and Stonington. That dynamic could emerge again in 2021 — in February, the Connecticut Judicial Branch posted auction details for a Field Point Drive mansion in Greenwich, after its owner snagged in the depths of the 2009 crisis for $8.5 million, then listed it for sale three years ago at more than $15 million without finding a buyer.

Millions of delinquent mortgages

As of February, foreclosures seizures were down 80 percent nationally according to Attom Data Solutions, which described millions of mortgages nationally as “seriously delinquent.” Individual states will have to deal with the issue at the expiration of any moratorium.

Connecticut General Assembly members dove into the issue this week, analyzing a bill that would make permanent the mortgage mediation program created after the Great Recession and naming it for Ezequiel Santiago, the late state senator from Bridgeport who advocated for homeowner rights. According to Connecticut Judiciary Branch data, more than 32,000 people have gone into the Foreclosure Mediation Program since 2008, with about seven in 10 being able to stay in their homes.

“While the volume of the need will change from year to year, the crisis for individual homeowners does not — and never will — go away,” stated Raphael Podolsky, an attorney and policy advocate with Connecticut Legal Services, in formal testimony supporting the bill. “Even in cases where the homeowner must leave, the FMP has increased the likelihood of sales in lieu of foreclosure — or in the worst cases, a more reasonable departure of the homeowner from the home.”

Regardless of the outcome of the legislative bill, the Greenwich-based Berkshire Hathaway broker Mark Pruner indicated the existing mediation program will extend many foreclosure auctions out in time, dampening any mass effect on the market immediately.

“It is common for the process to take two years,” Pruner stated in an email response to a query. “I’ve seen it stretched out to five years.”

Alex.Soule@scni.com; 203-842-2545; @casoulman