Eviction reprieve won’t aid everyone

How moratorium on rent will work for state’s tenants

By Alexei KoseffSACRAMENTO — California has a new partial eviction moratorium, the result of a last-minute push by state legislators to prevent struggling renters from being kicked out of their homes when courts reopen this week.

Gov. Gavin Newsom signed the moratorium into law late Monday, within hours of legislators passing it and just three days after the details were formally announced. AB3088 by Assemblyman David Chiu, D-San Francisco, grants tenants who are unable to pay their rent because of the coronavirus pandemic a reprieve and gives them five more months before they must start paying again in full.

The relief does not cover every California renter, however, or every eviction. Here are answers to questions about how the law works.

Am I protected from eviction? If you are experiencing a financial hardship because of the coronavirus pandemic that is preventing you from making rent, then this law covers you. That could be because of a loss of income — perhaps you were laid off or you had to stop working to care for a sick family member — or because of increased costs related to the pandemic, such as medical bills or child care that allows you to keep doing a job that has been deemed essential.

This law converts any rent you missed from March through August into civil debt, meaning you could not be evicted over the nonpayment, but your landlord could sue to recover the money in small claims court starting in March 2021.

From now through January, you’ll need to pay at least a quarter of your total rent. If you can meet the 25% threshold by Jan. 31, the rest of it will become civil debt. If you can’t, then your landlord could file to evict you in February.

How do I make sure my landlord knows I can’t be evicted? Your landlord is supposed to give you 15 days to affirm under penalty of perjury that you can’t pay your rent because of a coronavirus-related hardship. But if the landlord has proof you typically make more than $100,000 per year, and that is more than 130% of the median income in your area, you can be asked to document your loss of income.

If you don’t make this formal declaration, your landlord can seek to evict you for nonpayment starting Oct. 5. If you do and your landlord tries to evict you anyway, your landlord could be fined between $1,000 and $2,500.

Other eviction cases, such as those for violating a lease agreement, can resume immediately in most of the state. That’s not true in several Bay Area communities, however — San Francisco and Contra Costa County have frozen all evictions until the end of September, and Alameda County has extended its moratorium until the end of the year.

Many tenant advocates believe the state law does not go far enough and that evicting anyone in a pandemic is dangerous and cruel. They have unsuccessfully called on Newsom to stop all evictions through the end of the year and accused him of turning his back on renters with this law.

Is there is any relief for landlords? Not much. With the state facing a multibilliondollar budget shortfall, several proposals to provide direct financial relief to landlords for missed rent were shelved in the Legislature because of their cost. A separate effort to require mortgage forbearance for homeowners withered after banks and landlord groups raised concerns that it was unconstitutional.

The law does temporarily extend some additional foreclosure protections to landlords who own no more than three rental properties, each containing four or fewer units. If this is you, and any of your tenants is unable to pay rent because of the pandemic, then you are now covered under a state law that requires your mortgage servicer to contact you at least 30 days before foreclosure to explore alternatives. This right expires in 2023.

Landlord groups have noted that many rental property owners are struggling themselves right now, unable to meet their mortgage bills and other financial obligations because of missed rent payments from their tenants. They have criticized the eviction deal for balancing the crisis on their shoulders.

It doesn’t sound like anyone is satisfied with the law. Why the rush to pass it? They’re not. Even Chiu called it imperfect and said he was disappointed that it did not include stronger protections for tenants. But after weeks of intense negotiations involving Newsom, legislative leaders, tenants-rights advocates and landlord groups, those involved said this was the best deal they could get.

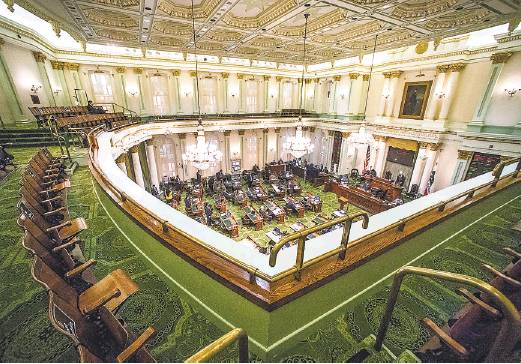

A statewide moratorium on eviction proceedings imposed by the court system is set to expire on Wednesday. Everyone at the Capitol felt intense pressure to do something to help millions of struggling Californians who might otherwise lose their homes.

So what happens at the end of January? That’s the million-dollar question. The state could find itself back in the exact same position five months from now, fighting again over how to avoid a wave of evictions.

Lawmakers are hoping for a miracle — either that Congress, which has been at odds for months over whether to pass additional coronavirus relief legislation, will get its act together and provide aid to renters and landlords, or that Joe Biden will win the presidency and reset the debate in Washington.

But a federal bailout is no guarantee. That makes it tricky for legislators as they continue discussions this fall about a more permanent solution to the eviction crisis.

Alexei Koseff is a San Francisco Chronicle staff writer. Email: alexei.koseff@sfchronicle.com Twitter: @akoseff