AN UNDERUTILIZED BENEFIT

Vets not signing up for tax exemptions

Qualifying individuals could save hundreds each year

By Barry Lytton

Most Connecticut veterans are eligible under state law for property tax exemptions that can save them hundreds of dollars a year on their tax bills.

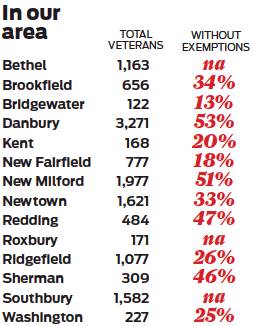

However, many vets who qualify for the exemption do not take advantage of it. In New Milford, for example, less than half the town’s nearly 2,000 veterans do so, and the same is true in Danbury, where just 1,540 of nearly 3,300 veterans have applied.

“I don’t know why so many don’t sign up, but they should,” said Jeff McBrearity, American Legion commander in New Milford. “It can save you a lot of money.”

To get the benefit under the state statute, a veteran must have served 90 days in the U.S. armed forces during wartime, or served 30 years in total. The definition of “war” is a broad one — under it, the Persian Gulf War has been fought without interruption since 1990 — but it includes shorter conflicts like the invasion of Panama, which took just one month in 1989.

The state requires local governments exempt $1,000 of the value of a home or car in assessing taxes, but many municipalities award additional exemptions based on income or disability. The exemptions are available to the surviving spouses of deceased veterans who qualify.

McBrearity’s exemptions added up quickly, he said: The $1,000 exemption mandated by the state, $2,000 offered by New Milford, and another break because of a disability saves him about $1,400 a year in taxes.

“I’m truly grateful for it,” he said.

McBrearity is one of 976 town veterans who signed up for the exemptions. Mary Zullo, a statistician in the assessor’s office, said the minimal savings are $80 a year and potentially much more with disability or income-based exemptions.

Town assessors and other officials say they’re not sure why more vets don’t take part in the program.

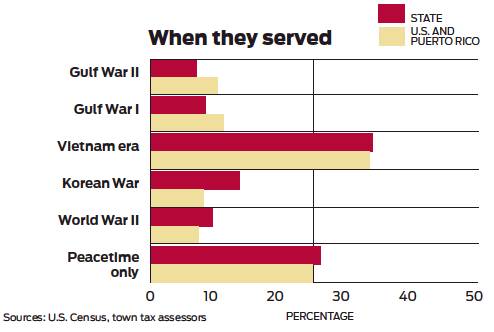

The wartime service limitation on eligibility excludes some veterans, but exactly how many is uncertain. According to U.S. Census figures, about a fourth of all Connecticut veterans served in peacetime, though it it not clear whether the definition coincides exactly with the definition in state statute.

Jim Lewis, commander of the Newtown VFW, said many vets simply don’t know about the program.

The point was echoed by Jim Delancy, commander of the New Milford VFW, who said there is a disconnect between some veterans and groups like the VFW that exist to help them.

“Unless they belong to an organization like the VFW or the Legion, they don’t know about it, ” Delancy said.

But other factors are likely at work, said Danny Hayes, a Gulf War veteran who is director of Veterans Affairs for Danbury.

“A lot of young guys don’t want help,” said Hayes, especially those who served in more recent conflicts in Iraq or Afghanistan. “They get out and they just get on with their lives.”

Disinterest in veteran’s benefits goes beyond tax exemptions. Only about 25 percent of veterans choose to sign up for the state Veterans Affairs Healthcare System, officials said.

“I think a lot of people just don’t know about it,” said Pamela Redmond, a spokesperson for the health care organization. “Or they think they don’t need it.” blytton@hearstmediact.com; 203-731-3411; @bglytton